While I was researching for our round the world trip—which has officially begun, now that I’m sitting on the airplane en route to Auckland as I type this draft we’re sitting in the living room of our self-contained flat where we’re WWOOFing north of Auckland—I wasn’t even considering bringing a debit card with me.

Then I found out that Charles Schwab offers a package brokerage and checking account online (only available to US residents, I’m afraid) that has no yearly fees, no minimum balance, no requirements of any kind, and they reimburse all ATM withdrawal fees including the ones you incur overseas. All that on top of no foreign transaction fees for using your debit card in a foreign country, plus a special number to call customer service from abroad (from any non-cell phone) for which Charles Schwab will accept the charges. They had me sold from the word go.

But before I get into further detail about the Schwab checking account, let’s talk a little bit about why you’d want a debit card in your wallet when you travel in the first place. Cash and credit cards should be plenty, right?

Well, most likely, but not necessarily. Credit cards are always my go-to form of payment because I love racking up points to use towards free flights (more on that in a future post, methinks), but credit cards are not always accepted everywhere you need them to be (hello, Japan, I’m looking at you). And for someone traveling for an extended amount of time, it just isn’t feasible to carry around all the cash you might need for your trip. Credit card cash advances are stupid expensive, so that’s why having a debit card in your arsenal comes in handy. You can keep a larger sum of money in your checking account back home and withdraw it as you go. ATMs tend to give the best exchange rates other than banks, so that is also a great way to make sure you aren’t losing out too much on daily rate fluctuations.

A quick note about exchanging money: Be sure to exchange domestic currency for foreign currency before you leave whenever possible since that will give you a better rate. Airports offer the worst rates, so only change there if you can’t avoid it.

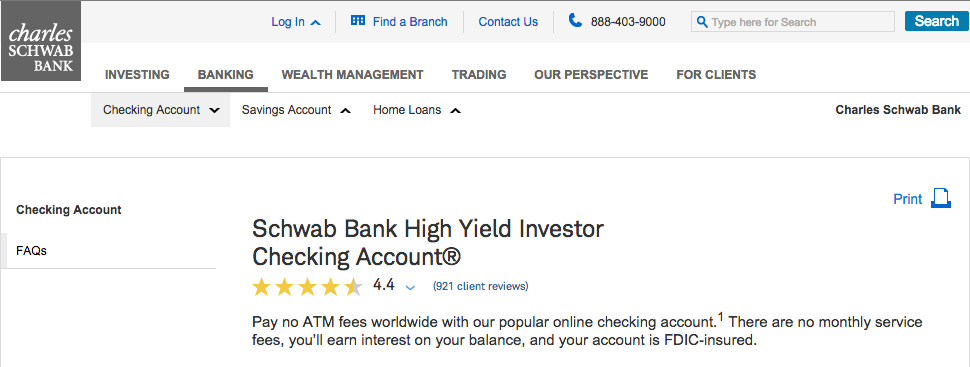

How To Open a Charles Schwab High Yield Investor Checking Account(R) In One Simple Step

Applying for the Charles Schwab brokerage and checking account package is easy. All you have to do is go to their site and either fill out the application online or print it out and mail it in, et voila. You don’t even need to use the brokerage account if you don’t want to, since there’s no minimum balance required.

This is where things get a little confusing. Not tricky, just unclear. See, when I first opened my Schwab account, I was operating under the assumption that they would mail me my debit card as soon as my account was created.

Not so, as I would find out during a web-chat with a company representative only a few days before I was due to depart.

Receiving the debit card for your account

Apparently you have to fund your checking account FIRST, and then they’ll mail your card, which will arrive within 10 business days.

Luckily I had already started the process of funding my account, but there was no way my card would arrive to me in time for our trip. The web-chat representative told me to phone the company, so I did, and I told that representative my sob story all over again.

“We can expedite the card to you via FedEx,” he said. “When are you leaving?”

“Saturday.”

I heard him inhale in that way people inhale when they have bad news they don’t want to tell you. Turns out he couldn’t assure me that I would receive my card in time even if I had it expedited to me, since it was Thursday night.

“Can I have you send it to my grandmather’s house?” I tried. “I’m going there for a few days before I leave the country.”

“Sure,” he said, sounding seriously happy he was going to be able to help me. “We just need a handwritten note and we can get that to you by Monday.”

Fantastic. I wrote and scanned a note in the exact way he had instructed me to, and Monday morning, the FedEx guy arrived with my card in hand at my grandma’s in California.

Moral of the story

DO get a Schwab checking account, but DO NOT wait until last minute like I did to get your Schwab account set up and funded. The customer service I received from Schwab, both online and on the phone, was superb. The initial set up of the account is a bit confusing, and funding the account can be a bit of a hassle from overseas if you choose not to link an external account, but all in all I think having a debit card that refunds you your ATM fees is well worth it.

How do you manage your money while you travel? Let us know in the comments!

Note: I’m not affiliated with Charles Schwab in any way, and none of the links in this post are sponsored.

I was thinking of opening a Charles Schwab checking account before I move to the Philippines where i will live as an expat from the U.S. How does one add funds to a Schwab checking account? Direct Deposit? Wire Transfers from another bank? The reason I ask is that I would like my retirement pension and social security deposited to a bank in the U.S. where it will remain safe and then I can withdraw funds as needed from ATMs in the Philippines.

Sorry for the belated response!!! Wire transfers you can definitely do; I’m fairly certain they allow direct deposit as well.

Yes, all of those work, direct deposit, photos of checks, etc.